Most of us have experience with basic spreadsheet packages, databases, and CRMs like Excel, Access, or Salesforce. These are common examples of machine learning.

More complicated are the advanced expressions that computer scientists write for high finance trading. All rely on search, update, replace, and other basic commands. By setting up procedures and calculations that process your property information, you too can start gaining valuable machine knowledge to make more deals. We’ll be discussing more about this in person during the TransACT 360 Tech Committee’s Program, “Collaborative Innovation”, on April 30 in Indian Wells, Calif.

Normally, the first step is to have a dataset to import. Basic property data is the County Tax Roll, which comes with very useful contact information and physical details. With very simple sorting, you can easily differentiate owner/users, corporations, and investors—useful depending on the type of campaign. Finding properties with extra land is made easier with the land/building calculation when the entire county is run automatically.

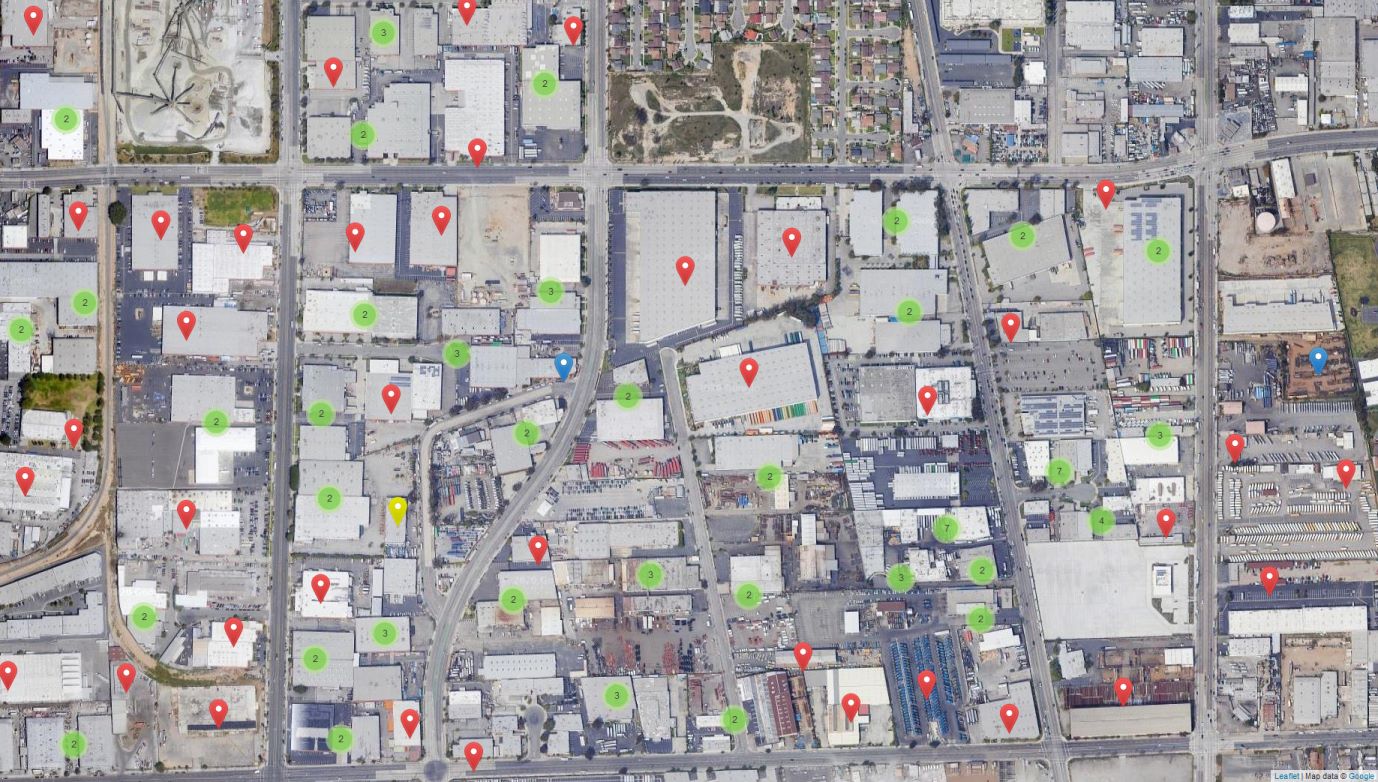

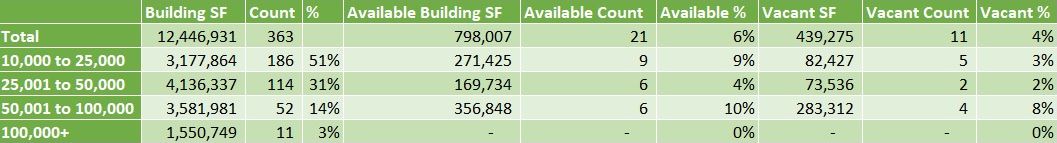

More power is added when linked to other databases like available inventory and occupiers. If your data is accurate you can quickly calculate vacancy rates in any size range or building condition. What’s also great is proximity marketing which is used to calculate the closest occupiers to the building. Something I’ve personally been experimenting with is image data—I use 360° cameras, Dash Cams, and geo-tagged photos to capture real-time data. The images show vacancies, broker signs, tenant names, and other useful information. While it’s time-consuming as we wait for pattern recognition to become affordable, it is perhaps the most valuable of all the data you can collect. Geodata is another field of data I find helpful because it easily references the most important real estate attribute: location.

While many of these examples apply to our brokerage lives, the big dollars are pouring into iBuyer programs that sift through market data to find deals. There are many examples within residential real estate where computers find the pricing discrepancies to earn at least 10% on a flip. So far, there are only limited examples in office and industrial property, but I expect this to change by year-end. When clients are able to manipulate market data better than the brokers, the industry is in trouble. Still, SIORs have local knowledge, relationships, and performance that can’t be replaced by machines.

Machine learning is applying computer science to your own data. Many new graduates—especially from community colleges—can get you started affordably. As your needs grow, you can outsource to experts in the areas you need most. However you decide to build your machine, it will be an investment that keeps retuning.

Gardena 90248 and 90061 Availability and Vacancy Stats

As published in SIOR Professional Report (Spring 2020 Issue)